Where Is the White Space in Drug Development?

January 20, 2026

Jonathan Tobin Partner at Brandon Capital

At Brandon Capital we spend most of our time creating and building companies discovering and developing new medicines that have the potential to deliver transformational benefit in important diseases. We will always invest in “traditional” (and competitive) areas such as oncology and immunology, but we’ve also never been shy about exploring less crowded fields like neuroscience, ophthalmology, paediatrics, infectious disease, and regenerative medicine.

Such areas contain enormous underserved clinical need, and in many cases the bar for clinical success is lower, differentiation easier to demonstrate, and the commercial opportunity massive.

Starting a new company now in extremely crowded indications – obesity, solid-tumour oncology, autoimmune diseases – particularly with a “best-in-class” rather than “first-in-class” proposition, carries execution and commercial risk. Competition is intensifying, particularly from the rapidly growing Chinese biotech sector capable of great speed and capital efficiency. It raises a question I return to repeatedly:

Where are the white spaces?

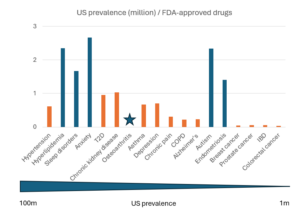

To attempt to answer this, I looked at where high disease prevalence (and therefore large commercial potential) intersects with a paucity of approved or late-stage drugs. To avoid simply identifying “low-hanging fruit” that is biologically intractable, I also overlaid a qualitative assessment of drug-discovery tractability.

Of course, areas of genuine white space often carry substantial technical and translational risk. Diseases may be poorly understood, heterogeneous, and inappropriately diagnosed – autism spectrum disorders being a clear example. Alternatively, the biology may be understood but the relevant targets difficult to drug safely (e.g. CNS-restricted or pathways requiring exquisite tissue specificity).

But our understanding of disease biology is improving fast, and the traditional focus areas are becoming increasingly saturated. Against that backdrop, now is a good time for early-stage investors to place well-reasoned, contrarian bets.

In the chart below, I ranked the top 20 diseases (not including obesity) in the US by total prevalence. For each disease I divided prevalence (in millions of patients) by the approximate number of FDA-approved drugs – counting individual molecules, not mechanistic classes. Stand-out diseases include: hyperlipidemia, autism, sleep disorders, anxiety, osteoarthritis, endometriosis.

Predictably, oncology and autoimmune conditions cluster at the low end of this ratio: reasonably high prevalence, but dozens of approved agents.

The high end of the ratio contains categories that VCs have traditionally avoided – sleep disorders, behavioural and neurodevelopmental conditions, chronic pain, and many forms of neurodegeneration – they have enormous patient populations but few approved drugs.

These represent opportunities where:

· Unmet need is massive,

· Competition is low,

· Clinical differentiation is easier to demonstrate,

· Incumbent pipelines are thin, and

· Scientific tools (genetics, iPSC models, systems neurobiology, spatial biology) are finally catching up.

Not every high-white-space category is investable today, but more are becoming so every year.

Why This Matters for Early-Stage investors

For founders and VCs, the implications are that:

- Crowded spaces require overwhelming superiority in biology, execution, or capitalisation to win.

- White-space areas reward insight, creativity, and true scientific innovation, with lower competitive and commercial pressure.

- The next wave of breakout drugs may more come from some of these overlooked domains.

As white space continues to shrink in traditional therapeutic areas, the opportunity – and imperative – for sophisticated early-stage investors is to look where others are not.