By Jonathan Tobin, Partner – Brandon Capital

Plenty is written about the trends in dollars and modalities being invested in oncology by VCs. But equally important are the exits, and for early-stage investors M&A is especially important. Exits fuel our sector by recycling capital to limited partners, entrepreneurs, and founding academic institutions.

ESMO ’25 was eventful, with practice-changing data from the ADCs Enhertu for breast cancer and Padcev for bladder cancer. It was particularly positive for two of Brandon Capital’s portfolio companies: Catalym, with excellent phase 2 data for its anti-GDF15 antibody in bladder, liver and lung cancers; and Advancell, with amazing early clinical data with its Pb212-based radioligand therapy in prostate cancer.

Like all themes in our sector, oncology modalities go in and out of fashion. Themes that attracted major headlines at ESMOs of 2015-20, but less so this year, included precision oncology (peaked 2018-21), checkpoint inhibitors (peaked 2016-18), and CAR-T (peaked 2016-20). The hot themes today include ADCs (although we are in the “3rd wave” of the field), RLTs, previously undruggable targets such as KRAS, and in vivo CAR-T.

In some ways, oncology innovators and investors are becoming victims of their own successes. As new products have raised the efficacy bar, the quality and quantity of clinical data required to trigger pharma interest has got higher, and the white space smaller. The data triggering blockbuster acquisitions five years ago is no longer sufficient. Oncology companies must tackle higher risk, higher reward indications such as colorectal, pancreatic and brain cancers, and take products further through clinical validation.

To understand some of the characteristics of successfully acquired oncology biotechs, I reviewed 42 VC-backed oncology acquisitions since the start of 2020 (where deal terms were disclosed). To control for outliers and uneven distributions in a relatively small dataset, I used medians rather than means. I looked only at upfront deal values, excluding milestones and earn-outs.

1. The median company raised $220 million and was acquired for $1.0 billion upfront

This equates to a multiple of 4.5x invested capital, which likely translates into a median upfront cash-on-cash return for VCs of around 3.5x. The pace of transactions has been relatively steady, around 8 deals per year, ranging between 2 and 9. Activity in 2025 year-to-date has been muted in oncology, though M&A has been more active in other therapeutic areas, particularly immunology and inflammation.

Capital raised before acquisition has clustered around $150–250 million, suggesting this is the “sweet spot” for generating the killer clinical data that drive an acquisition.

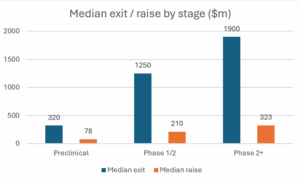

2. Stage of development drives value at acquisition

Deals were split fairly evenly across preclinical, early clinical, and late clinical companies.

- Preclinical: ~25% of transactions. Median raise $78 million; median acquisition value $320 million (4x).

- Early clinical (Ph1/2): ~33% of deals. Median raise $210 million; median acquisition $1.25 billion (6x).

- Late clinical (Ph2–Ph3): The largest share of deals. Median raise >$300 million; median acquisition ~$2 billion (7x).

This highlights the obvious stepwise increase in exit value as programs de-risk through development. But it also shows that preclinical exits are not uncommon, and provide a more time and capital-efficient exit for early-stage investors, even if they plan to keep funding through clinical data.

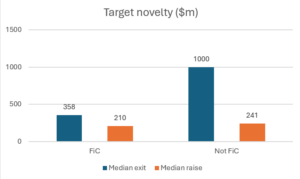

3. Target novelty may not be rewarded by acquirers

- First-in-class (FiC) / novel targets: Median upfront $360 million.

- Validated targets: Median upfront $1.0 billion.

Capital raised prior to exit was similar (~$200 million each). This suggests that acquirers are more comfortable paying for validated biology with a “me-better” molecule than novel biology that needs clinical validation, even if the latter has greater scientific “innovation”. Not surprisingly there were clusters of deals around validated “must-have” targets, such as PSMA, HER2, IL2, and validated targets in bispecific format (CD19, BCMA etc).

4. ADCs have delivered the best overall RoI, and cell therapy the worst

Antibody–drug conjugates (ADCs) stand out as generating the best overall returns, but this does not mean it will continue to be the case. At the other end of the spectrum, cell therapy companies have seen weaker exits, in part due to capital intensity and some distressed sales where companies struggled to raise funds. As we’ve seen lately with a spate of early-stage in vivo CAR-T acquisitions, it may be time for another bounce of the CAR-T ball.

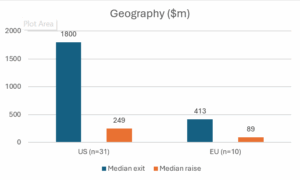

5. Geography matters

The US continues to dominate:

- US companies: Median exits 4x larger than Europe.

- US biotechs raised almost 3x more capital, yet still achieved higher multiples over capital raised (7x vs 4.5x).

This likely reflects the deeper capital markets in the US creating more data as well as optionality, as well as a higher proportion of the firms going public prior to acquisition (55% vs 40%) at the point of acquisition.

6. Who are the most active acquirers?

Lilly, AZ, Gilead, BMS, Merck and Sanofi top the dealmaking rank. But Top-20 pharmas are only responsible for 76% of all deals, so 24% of acquirers are mid- and smaller cap players such as Ipsen and Genmab.

Key takeaways

- Oncology M&A has delivered consistent billion-dollar exits, with early clinical-stage companies achieving the strongest multiples.

- Novelty alone does not drive acquisition value; acquirers are still paying up for validated biology.

- ADCs remain the hottest modality, while cell therapies have struggled.

- US biotechs have had an advantage over European peers in both funds raised and acquisition size.

- Three-quarters of acquirers are top-20 global pharma, however around one quarter are mid- and smaller cap specialists (like Genmab), so should not be ignored, particularly for early-stage deals.

Follow Jonathan on LinkedIn for more biotech, investment and innovation insights.